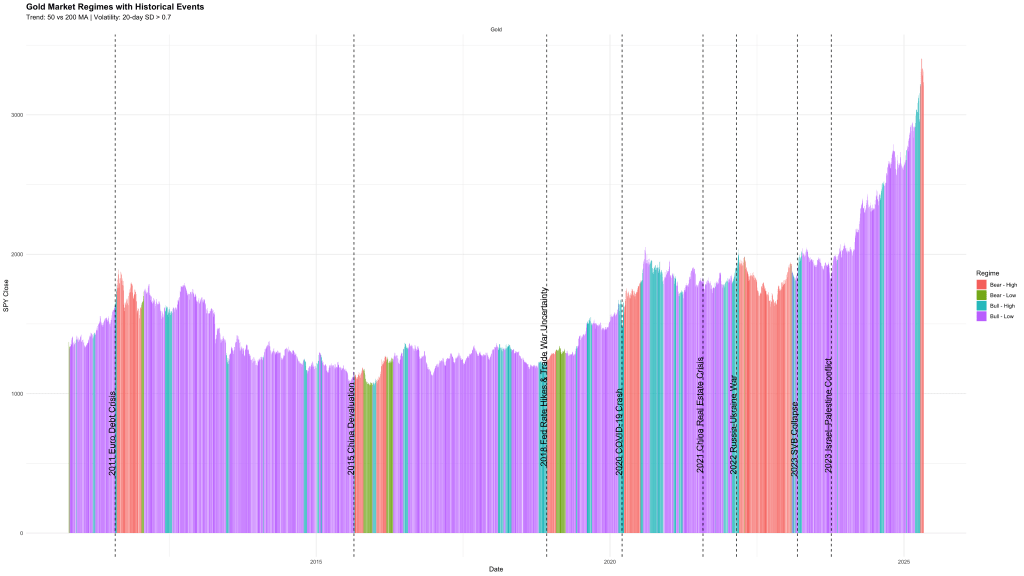

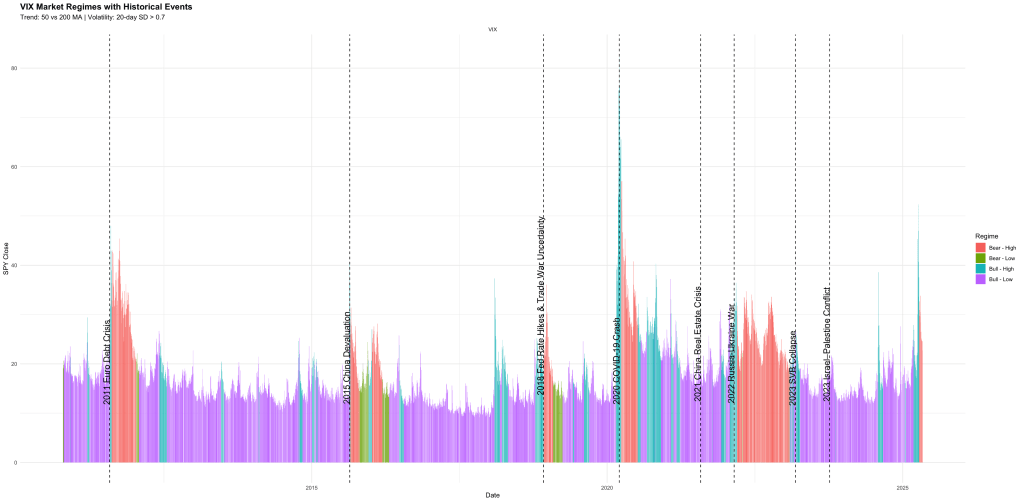

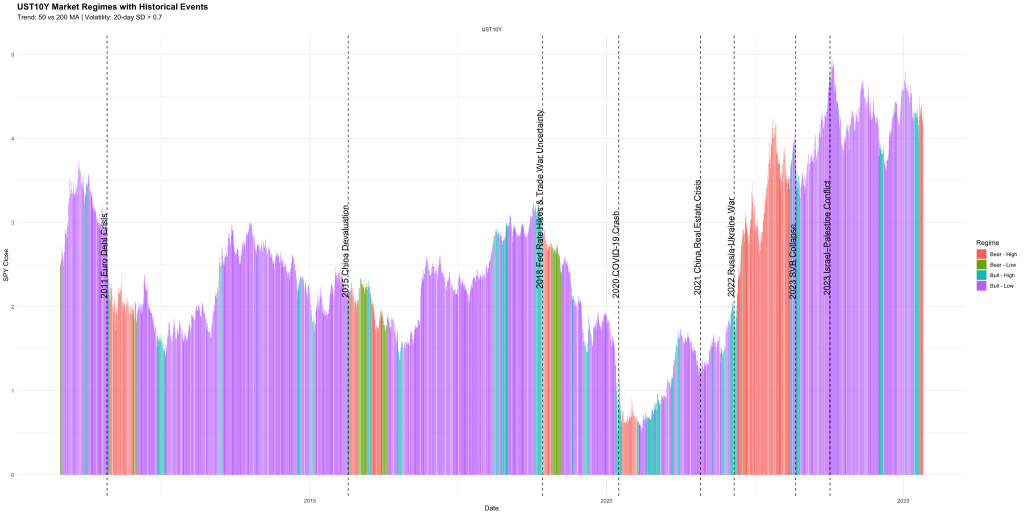

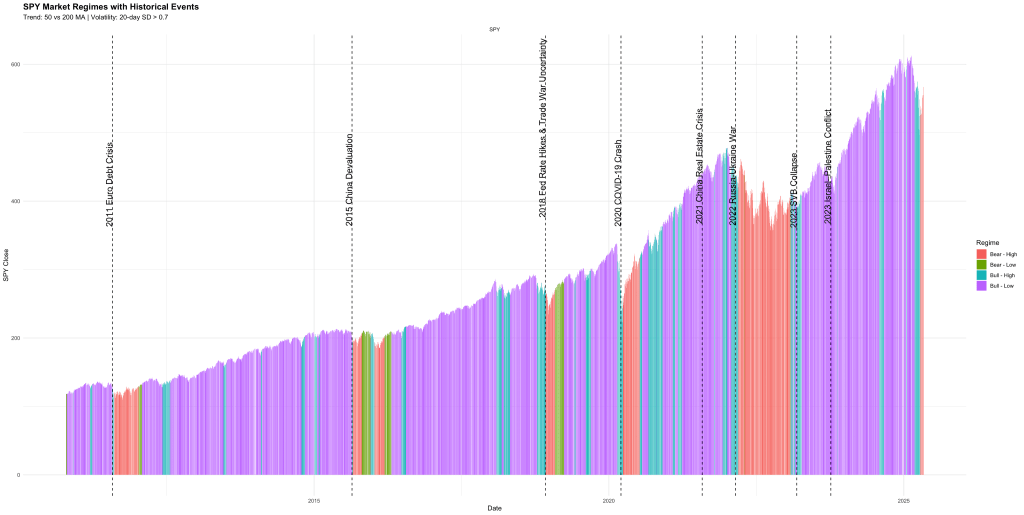

This document presents a market regime classification system applied to SPY (S&P 500 ETF) based on a combination of trend and volatility indicators. The goal is to identify market environments—Bull/Bear with High/Low volatility—and link them to historical macroeconomic and geopolitical events for validation.

Regime Classification Methodology

- Trend Detection: A Bull market is defined when the 50-day moving average (MA) is above the 200-day MA. A Bear market is defined when the 50-day MA falls below the 200-day MA.

- Volatility Regime: The standard deviation of the past 20-day returns is computed, and a fixed threshold (0.7) is used to separate high from low volatility.

- This results in four distinct regimes:

- Bull – Low Volatility (stable growth)

- Bull – High Volatility (uncertain optimism)

- Bear – Low Volatility (calm before the storm or post-panic)

- Bear – High Volatility (crisis periods)

Historical Market Events and Corresponding Regimes

The plot visualizes SPY’s closing price with colored bars indicating the regime at each point in time. Key macro events correlate strongly with regime changes:

- 2011 European Debt Crisis: Increased volatility and market weakness due to fears over sovereign defaults, particularly in Greece, Spain, and Italy.

- 2015 China Devaluation: China’s surprise yuan devaluation caused a global market panic, increasing volatility.

- Late 2018 Correction: The market briefly entered a Bear regime due to a combination of aggressive Fed rate hikes, escalating U.S.–China trade tensions, and a flattening yield curve.

- 2020 COVID-19 Pandemic: A sharp shift into Bear–High Volatility as lockdowns and uncertainty gripped global markets. This regime was followed by a dramatic V-shaped recovery into Bull–High Volatility as monetary and fiscal stimulus took effect.

- 2022 Russia–Ukraine War: A reentry into high volatility regimes due to geopolitical risk, energy supply shocks, and rising inflation fears.

- 2023 Israel–Palestine Conflict: Contributed to short-term volatility spikes, although not as prolonged as earlier crises.

- China Real Estate Crisis (2021–2023): Caused concern in global markets, especially related to systemic risk from Evergrande and related developers, seen as intermittent Bear–High spikes.

- 2023–2024 U.S. Regional Bank Failures: Signature Bank, SVB, and First Republic collapses sparked regime shifts due to liquidity fears and banking contagion risk.

Insights and Applications

This regime framework provides a robust lens for:

- Strategy Switching: Use momentum strategies in Bull–Low environments and mean-reversion in Bear–High ones.

- Risk Management: Position sizing and exposure can be adjusted based on volatility regime.

- Event Validation: Historical consistency of regime detection supports the model’s generalization ability.